Let our Texas Medical Care Plans team help you find the perfect plan for you.

We can help you select from a wide range of coverage, plans, and options to suit every need and budget.

Overwhelmed by the complexity of insurance plans?

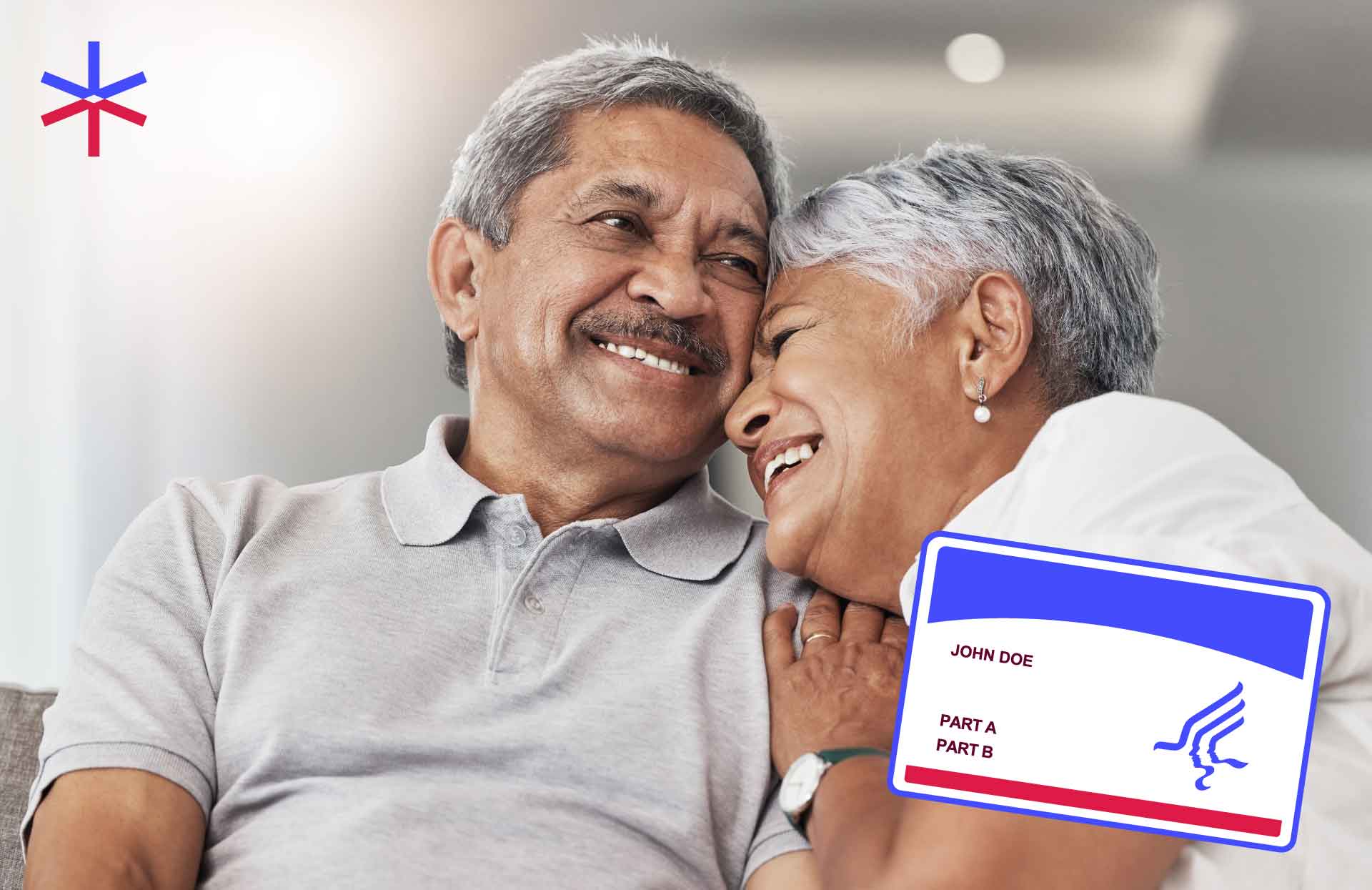

Medicare

Medicare is a federally funded program that offers medical care to those who are 65 years of age or older, disabled, or have end-stage renal disease. Medicare is made up of the original 1965 Part A hospital insurance plan and Part B medical insurance, which covers doctor visits and outpatient care. Medicare is divided into four parts:

Part A: Hospital Insurance

Part B: Medical Insurance

Part C: Private Medicare Advantage Plans

Part D: Prescription Drug Coverage

At Texas Medical Care Plans, we help you apply for Medicare completely free so you can get the most of benefits.

Obamacare

The Affordable Care Act, or Obamacare, is a law that President Barack Obama signed in March 2010 to change the way health care is paid for. It aims to extend health insurance coverage and improve access to healthcare for all Americans. The law does this by setting up a number of marketplaces, or exchanges, where people can get private health insurance. It also provides subsidies to help make the costs affordable and makes other changes that affect the healthcare system.

Obamacare provides quality, affordable health insurance designed to meet the needs of you and your family, and it offers a wide variety of plans that fit a variety of budgets. We can help you find the best option for you and your family.

Final Expense Insurance

Final expense insurance is used to cover the final costs of a funeral. However, it also provides a financial safety net for families who may be left with unexpected expenses after their loved one passes away. Final Expense Insurance covers:

- Unexpected medical bills

- Final cost of funeral services, burial, cremation, or other arrangements.

- Expenses related to a sudden death where the insured is not at fault.

The policy must have a service contract that lists all of the person’s wishes and instructions for how they should be handled. Most people qualify for Final expense insurance regardless of their health history.

Life Insurance

Life insurance can help protect your family financially if you’re unable to work due to death or illness. It also gives them emotional peace and reassurance in the event of your death. You need to make sure that you’re taking care of yourself so that you can take care of them. If something unfortunate happens to you and you don’t have a life insurance policy in place, your loved ones could lose everything they have.

Insurance for Small Groups and Businesses

Providing health insurance to employees is a great way for business owners to show they care about their staff and reduce employee turnover rates. By offering employees a choice between purchasing their own benefits or joining the company plan, this risk can be mitigated, and employees will be more likely to stay with the company for an extended period of time.

But many business owners shy away from providing health insurance because they are concerned about the cost. With Texas Medicare Plans, you don’t have to. We can guide you for free to choose the best plan according to the needs of your business without breaking the bank.

Request a Free Consultation

We will find a medical insurance for all

We are Texas Medical Care Plans, a health insurance company specializing in free Affordable Care Act assistance (better known as Obamacare) and Medicare Advantage Plans. For more than 10 years we have helped thousands of people find health insurance completely free of charge.

Frequently Asked Questions

Get answers to a few frequently asked insurance and benefits questions

Health insurance is a type of insurance that helps cover the cost of medical care. Insurers are known as healthcare providers and may offer a range of plans to individuals and groups. Some insurers pay doctors and hospitals directly, while others provide members with an allowance or fixed amount for services in each plan.

People with health insurance can have a higher standard of living thanks to improved access to preventative medical care and the peace of mind knowing they have financial protection in the event of an accident or illness. If you and your loved ones are insured against medical emergencies, you can rest easy knowing that you won't have to file for bankruptcy and can avoid adding stress to your life.

The cost of health insurance varies from person to person, company to company, and state to state. There are certain factors that can make the price higher or lower, like age, gender, smoking status, pre-existing conditions, and more. Other factors may include the amount you want to pay in copays, deductibles, and your personal and family financial situation.

The vast majority of people qualify for $0 per-month plans. Four out of five people can get a plan for $10 or less per month. But this depends on five factors: your annual income, family size, age, city, and the type of coverage you are looking for. Insurance companies often offer discounts for people with good health and low hospitalization risks. It's important to find out what your state requires before purchasing a policy.

To qualify for health insurance, you must meet the following requirements: You must be a U.S. citizen or legal resident, you must not be incarcerated, you must not have been convicted of certain crimes, and you must not be eligible for other types of coverage. In general, all people with legal status as citizens, residents, or people with work or student visas can access health insurance.

A deductible is an amount of money that you have to pay for healthcare services before your insurance starts to cover your expenses. It's usually in the form of a flat dollar amount or percentage of the total cost, and it can vary from plan to plan. For example, a $500 deductible means that you have to pay the full cost of any medical care up to $500 in a given year, and the insurance picks up the rest of the tab.

A copay is a fixed amount of money that you pay for a health care service or prescription drug. It is typically a percentage of the total cost. The amount is set by your insurance company, and you have to pay it before receiving the service or prescription. For example, if you need an MRI of your knee and your insurance plan has a $500 copay, you will have to pay $250 before the procedure.

A coinsurance is a percentage of the total cost that you as a patient must pay. The coinsurance percentage is usually between 20% and 50% of the total cost of your medical care. Coinsurance is frequently calculated as a percentage of the total cost, but it can also be calculated as a fixed dollar amount. For example, if you have an out-of-pocket maximum of $3,000 per year, then your coinsurance would be $300 per year ($3,000/12 months).

![[TMCP]-SEP-Popup-EN](https://texasmedicalcareplans.com/wp-content/uploads/2025/02/TMCP-SEP-Popup-EN.jpg.webp)